Summary

- A tariff on all Canadian imports to the United States would have serious consequences for the Canadian and BC economies.

- A 25 per cent tariff would push both the Canadian and BC economies into recession, and the impact could be compounded by a broader trade war and retaliatory tariffs by Canada.

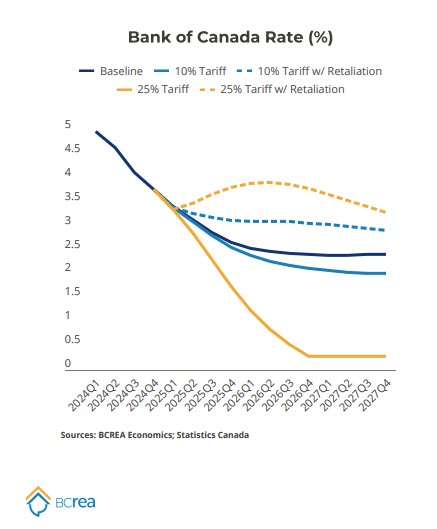

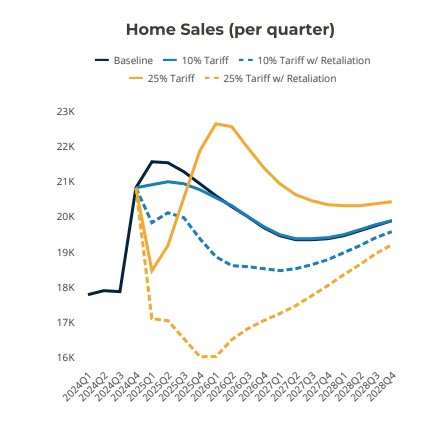

- Under the most likely scenario, the BC housing market would see a temporary decline in activity before posting a robust recovery as mortgage rates decline substantially, thereby unleashing pent-up demand.

Tariffs With Retaliation

A scenario involving two-way tariffs between Canada and the US appears much more likely with the Prime Minister and provincial premiers signalling an appetite for at least some degree of retaliation.

At a high level, retaliatory tariffs from Canada would deepen the negative economic impacts explored in our first scenario, but through different levers. While one-way American tariffs could be considered a negative aggregate demand shock to Canada, two-way tariffs are primarily a negative supply shock, which bears downstream effects on Canadian investment

and consumption.

Implications of Tariffs for the British Columbia Economy

Nonetheless, tariffs would still damage provincial GDP, as many of BC’s exports to the US appear to be fairly easy

for US firms to substitute away from in favour of domestic producers. Accordingly, a move away from British Columbian

goods drastically worsens our investment and employment environment. We saw this exact scenario play out in the BC

forestry sector following the imposition of a 20 per cent US tariff on softwood lumber. That tariff prompted a dramatic

decline in lumber exports, the production of manufactured wood products, and forestry employment. Indeed, the sector

bears the scars of that policy more than half a decade later. Our model estimates that a 25 per cent tariff would cause a

0.75 per cent to 1.1 per cent contraction in BC’s real GDP in the first year of the tariff, followed by slow but positive

growth the next year.

Implications of Tariffs for the British Columbia Housing Market

With regards to the economy, tariffs will have an unambiguously negative impact on economic growth

in BC and at a 25 per cent level could push the economy into recession. As we have seen from previous recessions,5 the

usual pattern for the BC housing market is an immediate decline in housing activity and then a robust recovery as the

central bank lowers rates to stimulate the economy. However, the effect on inflation caused by a potential Canadian

retaliation and the Bank’s ability to lower rates could shortcircuit the normal pattern.

BCREA publication: to view the latest Market Intelligence report PDF, click here.